Cement standoff: Manufacturers cry foul over opaque price controls in Ghana

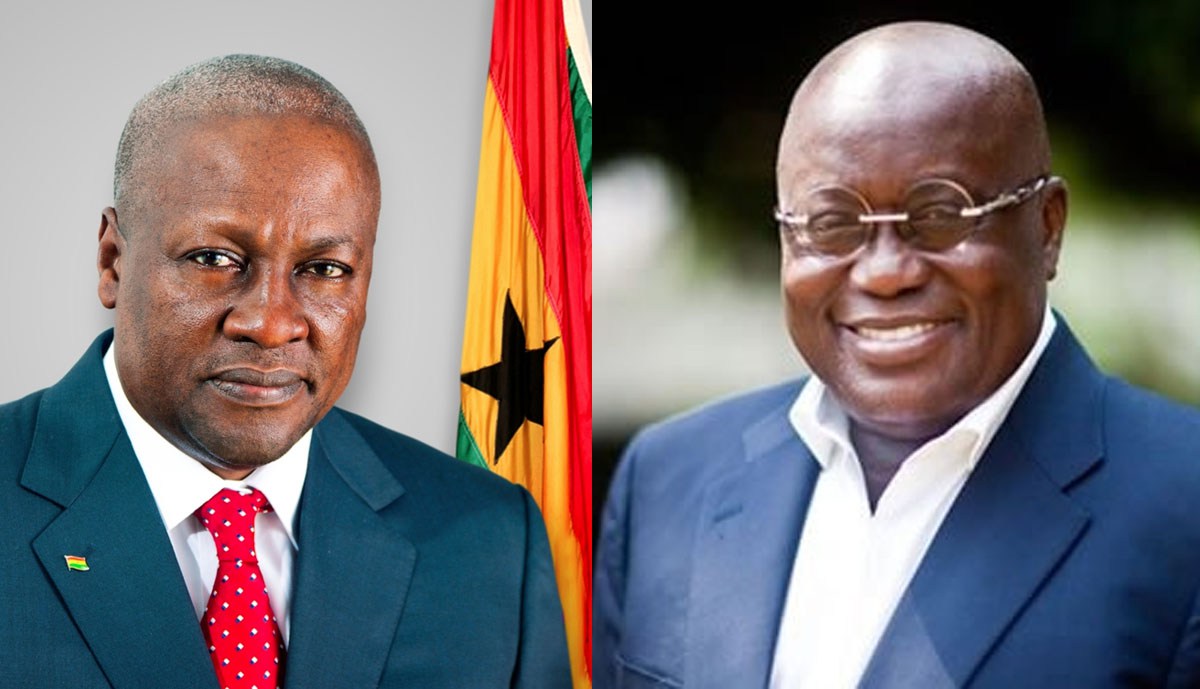

Ghana's construction sector faces a potential price war as the Chamber of Cement Manufacturers (COCMAG) clashes with the Ghana Standards Authority (GSA) over newly proposed price control regulations.

Ghana's construction sector faces a potential price war as the Chamber of Cement Manufacturers (COCMAG) clashes with the Ghana Standards Authority (GSA) over newly proposed price control regulations.

While the GSA, led by Director-General Prof. Alex Dodoo, presents the regulations as a means to ensure transparency, COCMAG views them as an opaque and heavy-handed attempt at price control.

Regulations raise concerns about unilateral power and lack of transparency

The core of the issue lies in the unilateral power granted to a government committee of scientists at the GSA. Regulations 3(4), 3(5), and 3(6) of the L.I. empower this committee to reject a cement producer's reported price without justification or a chance to appeal.

Producers are also prohibited from selling their product until the committee approves their price, with non-compliance leading to license suspension.

Industry questions expertise of the price control committee

While transparency in pricing is a positive goal, COCMAG raises concerns about the expertise of the price control committee (PCC). Composed primarily of scientists led by Prof. Dodoo, a pharmacist, the committee's expertise in quality standards is undeniable.

However, COCMAG questions whether scientists alone possess the necessary understanding of market dynamics crucial for setting a fair price for a complex commodity like cement. Can this committee effectively balance production costs, global and local material costs, and the long-term health of the industry against a free market approach?

Industry frustrated by lack of consultation

COCMAG further argues that these regulations were drafted without meaningful consultation. While the GSA might claim a meeting was planned, the details paint a different picture.

Cement companies were summoned via a last-minute WhatsApp message on a Sunday evening for a meeting the following day, with no agenda provided.

Upon arrival, CEOs found the media present, raising concerns about potential misrepresentation. Ultimately, they were informed the Minister was unavailable.

Challenges faced by the cement industry

Ghanaians should be aware of the challenges faced by the cement industry. The Cedi's 104% depreciation since 2022 significantly increased production costs, with 77% of inputs being dollar-denominated.

Despite these challenges, the industry has absorbed a significant portion of these costs, only raising prices by 48% in the same period. Without this absorption, cement prices would be $2.30/bag (GHS 35/bag) higher.

Competitive cement industry with low prices

Finally, Ghanaians deserve to know that their cement industry is a model of competition in West Africa, boasting one of the highest numbers of manufacturers in the region. Ghana's 14 producers outnumber Nigeria's 12 and Togo's five.

Ghana's cement prices are among the lowest in West Africa, though 30% of the cost goes to government taxes and fees.

The standoff between the cement industry and the GSA threatens to disrupt the construction sector and potentially raise consumer prices.

Striking a balance between transparency, fair pricing, and a healthy business environment seems to be the key to resolving this conflict.

What's Your Reaction?