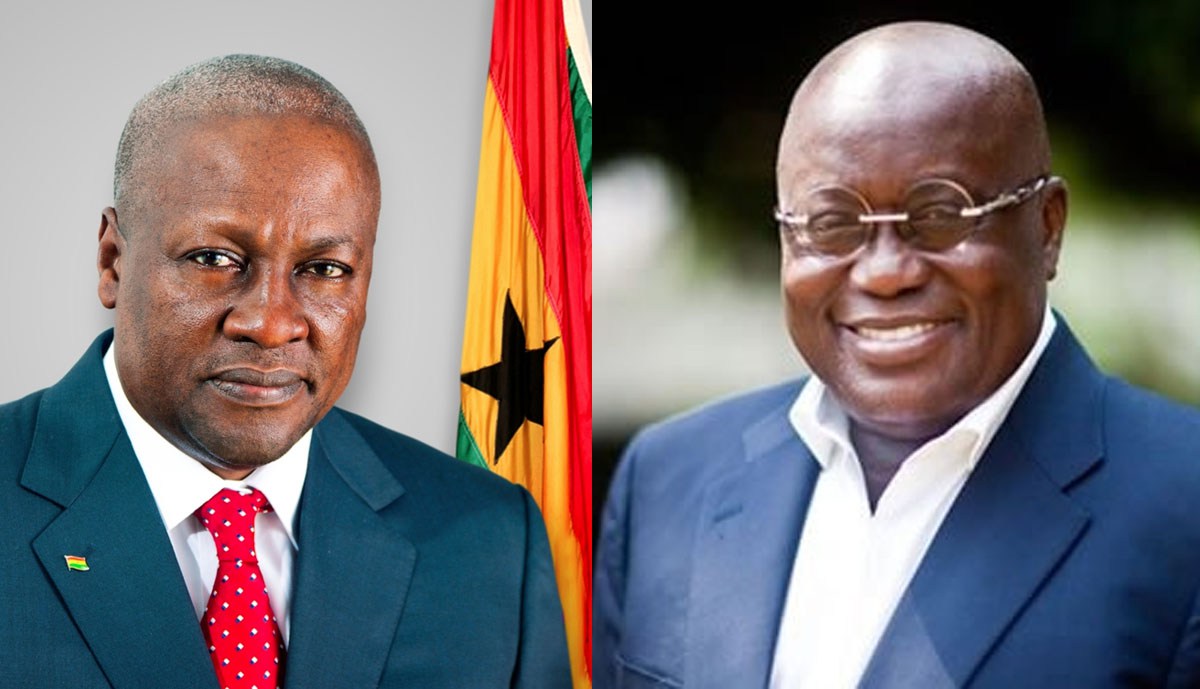

Minority petitions Supreme Court to suspend tax waivers granted to 1D1F companies

Three National Democratic Congress (NDC) Members of Parliament (MPs) have petitioned the Supreme Court to suspend the tax waivers granted to companies under the One District One Factory (1D1F) initiative.

Three National Democratic Congress (NDC) Members of Parliament (MPs) have petitioned the Supreme Court to suspend the tax waivers granted to companies under the One District One Factory (1D1F) initiative.

The MPs are Bernard Ahiafor (Akatsi South), Kwame Agbodza (Adaklu), and Emmanuel Armah-Kofi Buah (Ellembelle).

The reliefs they are seeking include:

“A declaration that upon a true and proper construction of the provisions of Article 174 of the 1992 Constitution of the Republic of Ghana, the ‘Parliamentary Memorandum’ dated 28th February 2019, by virtue of which the Minister for Finance sought Parliamentary approval for tax waivers for the One District One Factory (1D1F) Programme, is inconsistent with and in contravention of the said Article 174 of the 1992 Constitution and is accordingly unconstitutional, null, void and of no effect.”

“A declaration based on relief (i) above that upon a true and proper construction of Article 174 of the Constitution, the Parliamentary approval given to the Minister for Finance contained in the letter dated 3rd May 2019 with reference OP/T/R/0438 for tax waivers for the 1D1F Programme is inconsistent with and in contravention of the said Article 174 of the 1992 Constitution and is accordingly unconstitutional, null, void and of no effect.”

“A further declaration that upon a true and proper construction of Article 174 of the Constitution, the tax waiver requests by the Minister for Finance for and on behalf of forty-two private companies pending before Parliament for approval under the 1D1F tax waiver request approved by Parliament is inconsistent with and in contravention of the said Article 174 of the 1992 Constitution and is accordingly unconstitutional, null, void and of no effect.”

“An order of perpetual injunction restraining the Minister for Finance and the Commissioner-General of the GRA from taking any step(s) in furtherance of and to implement said 1D1F tax waivers for said forty-two private companies. An order of perpetual injunction restraining the Parliament of Ghana from taking any step(s) in furtherance of said 1D1F tax waivers for said forty-two private companies without evidence of compliance with Article 174 (1) and (2) of the Constitution 1992.”

Parliament last month approved an incentive package and tax waivers for the One District One Factory policy, despite opposition from the Minority.

The Minority argued that there was no amount mentioned, effectively giving a blank cheque to the operators in terms of tax waivers.

The package, which includes tax exemptions and tax holiday periods of up to five years, among other things, was under consideration at the committee level after it was presented to the House earlier.

What's Your Reaction?